Alumni and Friends

Planned Giving

You can use a variety of strategies and assets to support Harvard Chan School during your lifetime or upon your death, while also fulfilling your financial planning goals, including receiving income during your lifetime, passing assets to heirs in a tax-efficient manner, and more. Donors of any age can make a difference through planned gifts.

Please contact Carter Brown to learn more about these opportunities and to start your gift planning conversation today.

Common Types of Planned Gifts

Click on a gift type to learn more on the Harvard Gift Planning website.

- Bequests: Leave a specific amount or percentage of your estate, or its remainder, to Harvard Chan School.

- Beneficiary designations: Naming Harvard Chan School as a beneficiary of a life insurance policy or retirement plan, such as a 401(k) or IRA, is an easy, tax-efficient way to support the School. You can also make a qualified charitable distribution from an IRA during your lifetime, for those 70½ and older.

- Life income gifts: Establish a charitable gift annuity or charitable remainder trust to secure income for you or another beneficiary for life. The remainder of your gift benefits a Harvard Chan School initiative(s) you designate.

- Lead trusts: Support Harvard Chan School for a fixed number of years and transfer assets to children or other heirs, or retain them for yourself, while avoiding income and/or estate taxes.

- Donor advised funds: A Harvard Donor Advised Fund allows you to support Harvard Chan School and other charities over time while receiving an immediate tax deduction.

- Gifts of assets: Convert assets like real estate, private company stock, business interests, or art, to a meaningful gift to Harvard Chan School.

These days I don’t need more, more, more things—and that is why I am giving this bequest so that others can benefit from what this School demonstrates—a true global education in public health.

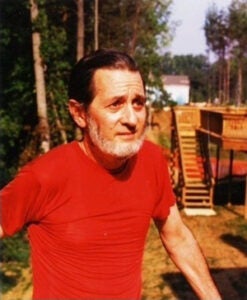

Stanley P. Bohrer, MD ’58, MPH ’75

Benefits of Planned Gifts

Making provisions for future gifts to Harvard Chan School through your will or estate plan is a meaningful way to make a lasting difference—and assets remain yours during your lifetime. These gifts, as well as beneficiary designations, can also be changed should your circumstances change.

For life income gifts, lead trusts, and donor advised funds, your assets are invested in the Harvard endowment or through TIAA Kaspick, depending on the type of gift, for no separate fee, making your gift go even further. These types of gifts, as well as gifts of complex assets, often provide many tax advantages during your lifetime and can also be a smart part of estate planning for many donors.

Because Harvard Chan School is always focused on the most pressing public health challenges, many donors choose not to specify a purpose for their planned gifts, including bequests, allowing the School to use their gift where it is needed most. If you prefer to direct your gift to a specific purpose, the Office of Development and Alumni Relations can help you or your attorney craft a plan that reflects your wishes.